Collections calls can be harmful to credit scores and financial stability. Debt consolidation loans without fees offer a solution by combining multiple debts into one loan with potentially lower interest rates, simplifying repayment and improving cash flow. This strategy is beneficial for high-interest debt holders, reduces stress, and enhances financial control, stopping collections calls in the process. Choosing a no-fee loan saves money, provides transparency, and allows borrowers to manage their finances effectively, moving towards financial stability and improved credit scores.

Tired of relentless collections calls? Stop the cycle with a strategic debt consolidation plan. This comprehensive guide explores effective solutions, focusing on debt consolidation loans with transparent, no-hidden-fees structures. Learn how this approach simplifies repayment and relieves financial stress. Discover the advantages, selection criteria, implementation steps, and post-consolidation tips for achieving lasting financial stability.

- Understanding Collections Calls and Their Impact

- Debt Consolidation: A Comprehensive Solution

- Advantages of Loans with No Hidden Fees

- Choosing the Right Debt Consolidation Loan

- Steps to Implement a Successful Plan

- Maintaining Financial Stability After Consolidation

Understanding Collections Calls and Their Impact

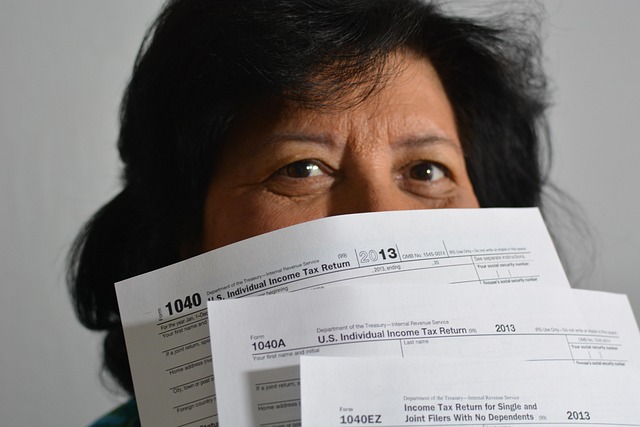

Collections calls can be a relentless and stressful part of dealing with debt. These calls from creditors or collection agencies are designed to recover outstanding balances, but they often leave individuals feeling overwhelmed and anxious. The impact of frequent collections calls can extend beyond emotional distress; they can negatively affect your credit score, make it harder to obtain loans in the future, and even contribute to increased stress levels.

Understanding that these calls are a last resort for creditors after attempts to collect debts directly have failed is crucial. Many individuals find themselves in a cycle of borrowing to cover immediate expenses, leading to mounting debt over time. A debt consolidation loan no fees offers a strategic approach to break free from this cycle by reorganize finances effectively. This method allows borrowers with multiple debts to consolidate them into a single loan, making repayment more manageable and potentially fixing credit score issues associated with frequent collections calls.

Debt Consolidation: A Comprehensive Solution

Debt consolidation is a comprehensive solution for managing and repaying multiple debts. By consolidating your debts into a single loan, you can simplify your financial obligations and potentially reduce the overall interest rate. This strategy is especially beneficial for individuals burdened by high-interest credit card debt or loans with variable rates. A debt consolidation loan, often available without fees, allows borrowers to make one consistent monthly payment, eliminating the hassle of multiple due dates.

One of the significant advantages of this approach is its impact on reducing stress and improving cash flow. With a consolidated loan, you can focus on paying off your debt more efficiently. Additionally, for those with lower credit scores or a history of missed payments, debt consolidation can be an accessible option. Many fee-free debt settlement programs offer this service, providing an opportunity to regain control over finances without additional charges.

Advantages of Loans with No Hidden Fees

When considering a debt consolidation plan, one of the key advantages of opting for loans with no hidden fees is the transparency it offers. These loans provide borrowers with complete clarity regarding interest rates and repayment terms from the outset. By eliminating surprise charges, individuals can effectively manage their finances and make informed decisions about their debt obligations. This approach is particularly beneficial for those looking to stop collections calls and gain control over their debts.

Avoiding debt collection agencies becomes more feasible with debt consolidation loans no fees. By consolidating multiple debts into a single loan with transparent terms, borrowers can simplify their repayment process and reduce the stress associated with dealing with multiple creditors. Additionally, lowering monthly debt payments is achievable since these loans often feature flexible repayment options tailored to individual financial capabilities. This allows for a more manageable budget and can significantly improve one’s overall financial well-being.

Choosing the Right Debt Consolidation Loan

When exploring how to stop collection calls with a debt consolidation plan, selecting the right debt consolidation loan is a crucial step. Look for options that offer no fees, as these can save you money in the long run. It’s important to compare interest rates and repayment terms from various lenders to find one that aligns with your budget. Remember, the goal is to fix high-interest debt and consolidate my loans into a single, manageable payment.

Opting for a loan with no hidden fees ensures transparency and allows you to focus on achieving debt relief options. This approach can simplify the process of managing your debt and put you in control. With careful research, you can find a suitable debt consolidation loan that helps you break free from collection calls and takes significant steps towards financial stability.

Steps to Implement a Successful Plan

Implementing a successful debt consolidation plan requires strategic steps to achieve financial freedom. Firstly, assess your current financial situation by listing all debts and their corresponding interest rates. This step is crucial as it enables you to identify areas where consolidation can offer the greatest savings. Next, explore various debt consolidation options, including loans with no fees, which are ideal for those looking to avoid extra charges. Compare interest rates, repayment terms, and any associated fees to find the best fit.

For seniors or anyone aiming to fix credit score issues, consolidating debts can be a game-changer. It provides an opportunity to simplify multiple payments into one manageable loan, reducing stress and potential late fees. Ensure you choose a reputable lender offering transparent terms and conditions. This strategy not only helps manage existing debt but also improves your credit score over time by demonstrating responsible financial management.

Maintaining Financial Stability After Consolidation

After successfully consolidating your debts with a zero-fee loan, maintaining financial stability is crucial for a fresh start. One significant benefit of debt consolidation is reduced monthly payments, which can free up a substantial portion of your income that was previously allocated to multiple creditors. This newfound financial flexibility allows you to prioritize savings and address any outstanding balance more effectively.

Consider seeking non-profit financial counseling services to help manage your budget and ensure your long-term financial health. These organizations provide valuable tools and resources for navigating post-consolidation life, offering strategies to avoid future debt accumulation and build a secure financial future.

Debt consolidation loans with no hidden fees offer a clear and effective path to ending collections calls. By understanding your options, choosing the right loan, and implementing a successful plan, you can gain control of your finances and secure a stable future free from the stress of overwhelming debt. Remember, a well-managed debt consolidation strategy is not just about paying off debt; it’s about achieving financial peace of mind.